The agentic AI market faces an unusual predicament: too much innovation, not enough adoption. According to Gartner’s latest research, the supply of agentic AI models, platforms, and products now far exceeds enterprise demand—triggering a market correction that will reshape the vendor landscape by 2027.

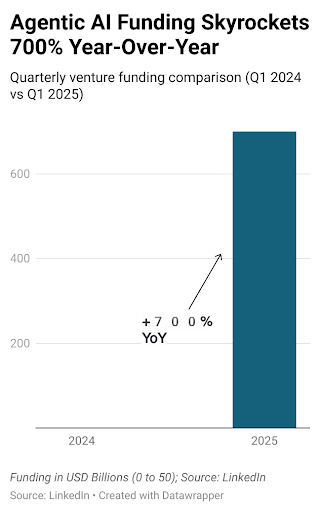

The numbers tell a stark story. Between January 2023 and May 2025, over $9.7 billion flooded into agentic AI startups. In Q1 2025 alone, agentic AI funding exploded to $46.5 billion, up from just $5.7 billion in Q1 2024—a staggering 700% year-over-year growth. The vendor count surged from approximately 40 startups in mid-2024 to 52 by June 2025, with over 50 major enterprise players now competing in the space.

Despite this explosive supply-side growth, enterprise adoption remains stubbornly cautious. Whilst 79% of US executives claim their companies are adopting AI agents, only 37% are actually using agentic AI in production—a 42-percentage-point gap that reveals the chasm between aspiration and execution.

“While we see early signs of market correction and consolidation, product leaders should recognise this as a regular part of the product life cycle, not a sign of inevitable economic crisis,” says Will Sommer, Senior Director Analyst at Gartner. But he adds a critical caveat: “Over 40% of agentic AI projects are expected to be scrapped by 2027 due to rising costs, unclear business value, and poor risk management.”

The correction has begun.

Understanding Agentic AI: Beyond the Marketing Hype

Before examining why the market is correcting, it’s essential to understand what genuinely constitutes agentic AI—and why confusion around this definition has contributed to oversupply.

The spectrum for true agentic systems ranges from simple automation (rule-based workflows) to multi-step orchestration (AI-guided task sequences) to genuine autonomous agents (systems that independently plan, execute, and learn). The challenge? Many vendors have rebranded existing automation and AI-powered tools as “agentic AI” without delivering true autonomous capabilities.

This definitional inflation has created market confusion. When everyone claims to be agentic, enterprise technology leaders struggle to distinguish genuine capability from repackaged robotic process automation (RPA). The low barrier to entry—thanks to accessible LLM APIs post-ChatGPT—enabled a flood of vendors to rush “agentic” offerings to market, many lacking meaningful differentiation.

ALSO READ: AI’s Real Challenge Isn’t Invention—It’s Execution

For enterprises, this matters enormously. The technical bar for agentic AI is high: systems must handle complex reasoning chains, integrate with multiple data sources and tools, maintain context across sessions, and operate reliably enough to warrant autonomous decision-making. Few solutions currently meet this standard at enterprise scale.

The Supply-Demand Imbalance: Why It Happened

The agentic AI supply explosion stems from a perfect storm of technological breakthrough, investor FOMO, and competitive land-grabbing.

The ChatGPT Catalyst

Post-November 2022, the success of conversational AI convinced every technology vendor that agentic capabilities were the next frontier. LLM APIs made it easier than ever to build agent-like interfaces, lowering technical barriers to market entry. The result: a vendor proliferation that outpaced enterprise readiness.

The Investment Flood

Venture capital poured in at unprecedented rates. European AI agent startups alone raised €1.7 billion in 2024, whilst Q1 2025 saw over 200 agentic AI deals recorded—a 63% year-over-year increase. With the enterprise agentic AI software market valued at just $1.5 billion in 2025 but projected to surge to $41.8 billion by 2030, investors bet heavily on future growth.

The Big Tech Land Grab

Microsoft, Google, Salesforce, ServiceNow, and Oracle simultaneously launched agent platforms, creating a “me-too” effect across the industry. Major consulting firms—Accenture, Deloitte, Capgemini—rapidly repositioned existing services under the agentic AI banner, further saturating the market.

ALSO READ: Agentic AI Supply Exceeds Demands, Says Gartner

Why Demand Couldn’t Keep Pace

Despite vendor enthusiasm, enterprise adoption has stalled for several critical reasons:

Integration Complexity: Most enterprises lack the data infrastructure required for agentic AI. Legacy systems don’t expose standardised APIs, data quality remains poor, and governance frameworks aren’t ready for autonomous decision-making. Development costs range from £160,000 to £800,000+ for enterprise-grade deployments, with hidden ongoing costs for continuous training (£4,000-£24,000), data quality improvements (£8,000-£20,000), and monitoring (£8,000-£28,000+ annually).

Trust and Control Issues: Enterprises remain hesitant to cede decision-making to autonomous systems, particularly in regulated industries like financial services and healthcare. Questions around explainability, liability, and regulatory compliance remain largely unresolved.

ROI Ambiguity: Whilst 62% of leaders expect over 100% ROI from agentic AI, most deployments are expected to break even only in year two, with just 29% ROI for single-agent deployments after two years. This uncertain return makes business case approval challenging.

Use Case Mismatch: Vendors built horizontal platforms promising universal application, but enterprises need vertical solutions addressing industry-specific workflows, compliance requirements, and data models.

ALSO READ: Know When to “Collect on the Gains” of AI

Agentic AI requires 2-5 times more tokens per workflow than generative AI, and 5-9 times more for larger multi-agent systems, significantly raising operational costs beyond initial projections. As Gartner warns, “a ‘speculative bubble’ could still form if investment becomes detached from agentic AI’s intrinsic potential to deliver tangible and commensurate economic value.”

The Consolidation Wave: Who’s Acquiring Whom

The market correction is already reshaping the vendor landscape through a rapid consolidation wave favouring capital-rich incumbents and domain specialists.

Major Acquisitions Signal Shift

In 2025, Capgemini completed its acquisition of WNS, creating what the company calls “a global leader in agentic AI-powered intelligent operations.” This wasn’t a technology acquisition—it was a play for vertical integration, combining consulting services, domain expertise, and installed customer bases.

ServiceNow acquired Moveworks, whilst NiCE acquired Cognigy, as platform vendors moved to incorporate specialised capabilities. Accenture invested in Lyzr, an enterprise agent infrastructure platform, specifically to bring agentic AI to banking and insurance sectors—a clear vertical focus.

These follow Salesforce‘s earlier acquisitions of Airkit AI (September 2023), Spiff (December 2023), and Tenyx (late 2024), systematically building agent capabilities across customer service automation, incentive platforms, and voice-agent expertise ahead of its Agentforce platform launch.

The Consolidation Thesis

Acquirers are pursuing four strategic objectives:

Vertical Integration: Building end-to-end stacks that combine platforms, pre-built agents, and domain expertise. Capgemini-WNS exemplifies this approach—delivering complete intelligent operations rather than standalone tools.

Talent Acquisition: Securing AI researchers and specialised engineering teams who understand the nuances of autonomous systems.

Customer Base: Buying installed enterprise customers provides immediate market access and validates product-market fit.

IP and Differentiation: Acquiring unique capabilities—voice processing, domain-specific models, orchestration frameworks—that differentiate commodity LLM-based offerings.

Winners and Losers

The consolidation creates distinct categories of survivors and casualties:

Winners: Capital-rich incumbents (Microsoft, Salesforce, ServiceNow), vertical specialists with domain expertise (particularly in financial services, healthcare, legal), and consulting firms positioned as systems integrators (Accenture, Deloitte, Capgemini) who profit from implementation services regardless of which platform wins.

Losers: Undifferentiated horizontal platforms lacking clear use cases, late-stage startups without acquisition prospects or path to profitability, and investors who backed companies at inflated valuations during the 2024 peak.

As Gartner notes, “consolidation will benefit capital-rich incumbents and those with domain-specific expertise, whilst undifferentiated startups and investors may lose out.”

The market is moving from hundreds of vendors to what analysts predict will be 10-15 major players by 2027, with vertical leaders emerging in each industry.

Enterprise Reality: The Implementation Gap

Whilst vendor consolidation accelerates, enterprises grapple with the practical realities of agentic AI implementation—and the gap between promise and performance remains substantial.

What’s Actually Working

Despite challenges, certain use cases are delivering measurable value, particularly where enterprises have clean data infrastructure and well-defined processes:

Customer Service Automation: Enterprise clients including Big Basket, Al Ansari Exchange, and Byjus work with USM Business Systems on agent-driven support. However, successful implementations maintain human handoff protocols rather than full autonomy.

Internal IT Support: Dell, Morgan Stanley, and Anthem have deployed Cognitivescale’s governance-focused agents for internal helpdesk functions, where error tolerance is higher and data is more controlled.

Financial Services Compliance: Accenture’s partnership with Lyzr enables secure, compliant AI agents for banking and insurance, automating customer support, claims processing, and policy renewals—use cases with clear regulatory requirements and structured data.

Specialised Workflows: PayPal, Capital One, and Kaiser Permanente work with H2O.ai on predictive modelling tasks, whilst Grammarly, Duolingo, and Samsara use Glean for enterprise knowledge AI.

The pattern is clear: success comes from narrow, well-defined use cases with clear ROI metrics, not enterprise-wide autonomous systems.

Why 40% Will Fail

Gartner’s prediction that over 40% of agentic AI projects will be scrapped by 2027 reflects four primary failure modes:

Unclear Business Value: Many projects launched to “do AI” without specific ROI targets, remaining trapped in perpetual proof-of-concept phases. Enterprises struggle to measure the incremental value of autonomous agents versus traditional automation.

Cost Overruns: Organisations underestimated data preparation costs, ongoing LLM API expenses, and integration labour. The 2-5X token multiplication for agentic workflows versus generative AI creates operational costs far exceeding initial projections.

Trust and Governance Failures: Agents making unexplainable errors, compliance concerns, and security vulnerabilities have shut down promising pilots. Without robust guardrails and monitoring, enterprises can’t risk autonomous decision-making in production.

Technical Limitations: Hallucinations, inability to handle edge cases, and brittle integrations that break when systems change plague current implementations. The technology, whilst rapidly improving, isn’t yet reliable enough for mission-critical autonomous operation at scale.

ALSO READ: The First-Mover’s Guide to Agentic AI: A 5-Step Framework for Success

Experts on Navigating the Correction

Industry leaders emphasise that the current correction represents market maturation rather than failure of the underlying technology.

“The impending agentic AI market correction is distinct from speculative bubbles fuelled by systemic financial engineering, fraud, or policy,” explains Gartner’s Will Sommer. “At this point, the underlying product, agentic AI, is sound, and the current market correction, where markets rationalise and consolidate, is a regular part of the product life cycle.”

Yet Sommer warns that the risk hasn’t passed entirely: “However, a ‘speculative bubble’ could still form if investment becomes detached from agentic AI’s intrinsic potential to deliver tangible and commensurate economic value.”

The caution echoes broader concerns from financial authorities. The Bank of England has alerted to a potential dotcom bubble 2.0, likening AI stock valuations to the late 1990s bubble, whilst IMF chief Kristalina Georgieva has warned of market shocks threatening global growth due to AI valuation optimism.

For enterprise technology leaders, the message is clear: the technology is real, the long-term potential remains substantial, but near-term vendor viability varies dramatically.

Sommer offers reassurance on the longer-term outlook: “Over the longer term, consolidation will enable industry leaders to develop agentic products that meet the technical and business requirements of customers who are presently struggling to adopt AI agents.”

The projection that agentic AI will represent 31% of the total generative AI market by 2030 (up from just 6% in 2025) and could unlock an additional $2.6 trillion to $4.4 trillion in value according to McKinsey estimates, suggests the prize remains enormous—for those who navigate the correction successfully.